We hear from prospective customers all the time that water rate reviews are time consuming, difficult, and often expensive. The result is that they tend to either hire consultants to do rate reviews infrequently or they do regular in-house reviews that lack depth. I’ve come to realize that it doesn’t have to be that way. There is a best-practice approach, one based on your fiscal year, that isn’t just easier and less expensive, it’s one that produces far better results.

We hear from prospective customers all the time that water rate reviews are time consuming, difficult, and often expensive. The result is that they tend to either hire consultants to do rate reviews infrequently or they do regular in-house reviews that lack depth. I’ve come to realize that it doesn’t have to be that way. There is a best-practice approach, one based on your fiscal year, that isn’t just easier and less expensive, it’s one that produces far better results.

Four Typical Approaches:

First let’s take a look at the four approaches we’ve found to be the most common among the water service providers we talk to.

1A and 1B: One Consultant-Prepared Rate Review, Two Outcomes

We come across many water utilities who engage consultants to perform a full rate review, usually about every five to ten years but sometimes more often. These consultant-prepared reports generally produce one of two outcomes:

- 1A: The utility will receive the consultant’s report and then implement none of the recommended rate updates.

- 1B: The utility will implement the consultant’s rate recommendations in some form, e.g. scheduling an annual increase of 3% for five years, based on a recommended 15% rate increase.

Utilities rely on consultants for a variety of reasons – (see Water Rate Consultants: Tomorrow’s Steam Train Engineers?) – but it basically boils down to comfort and familiarity. However, consultant reviews are labor intensive and extremely expensive. Based as they are on a snapshot of data that quickly becomes stale, they also fail to take into account the fact that things change over time – usage and revenue fluctuate, costs increase, regulatory requirements change.

2: In-House Rate Review (or Rate Review Lite)

Some utilities avoid the expense of consultants by bringing their rate reviews in-house. This approach normally involves analyzing data using complicated and cumbersome Excel spreadsheets that are difficult to work with (and that can sometimes break, meaning formulas get overwritten or links go out-of-date). This approach allows you to do reviews at your own pace, which typically means yearly reviews and rate updates. But – and this is a big but – this kind of review often lacks depth, it’s time consuming, and there is no support available. I call this approach Rate Review Lite because despite its advantages, utilities rarely invest enough time or effort to do a meaningful review that accurately reflects costs and revenue needs.

3: Cost of Living Rate Increases

This third approach is one of the simplest. It involves raising water rates annually based solely on cost of living increases, for instance linking increases to the Consumer Price Index or arbitrarily choosing, say, 3%. While the ease of this approach can make it appealing, the fact remains that it probably won’t reflect your actual costs.

4: Doing Nothing

Perhaps the most surprising approach is one that involves doing nothing. No rate reviews and no rate changes. Sometimes we see this go on for many years or even decades. The easiest of all, this approach is also a major contributing factor to the growing infrastructure deficit facing so many communities in North America.

A Better Way

Now let’s take a look at an alternative approach, one that puts you in the driver’s seat. Your existing fiscal year cycle probably looks something like this:

What we’re suggesting is integrating a more comprehensive water rate update within that process every year, usually within the budgeting phase. Instead of relying on external consultants or depending solely on internal staff who are already too busy, efficient rate updates become an integrated part of the regular cycle.

Even more importantly, though, we’re suggesting that you take control and base those updates on an evolving, long-term roadmap that starts with an in-depth analysis – an analysis you can do yourself, with the right tools. And by integrating annual updates into your process, your data no longer remains static and will be kept up-to-date.

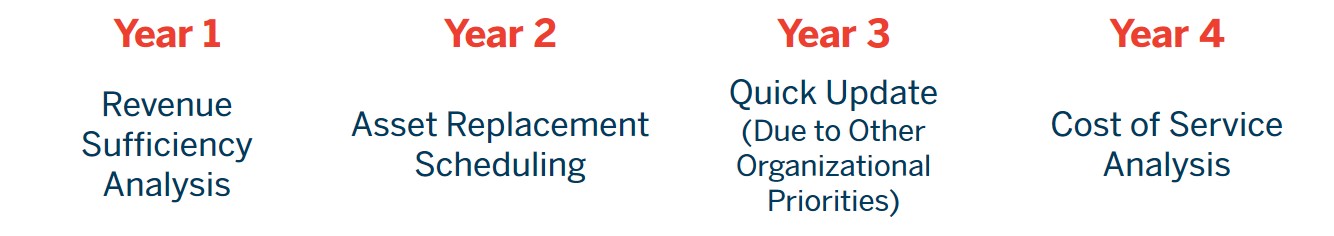

The details of your specific roadmap will depend on your organization’s priorities — your goals and objectives. Once you’ve defined your objectives you’ll have a much easier time establishing a long-term roadmap. The graphic below is just one example of a possible roadmap. The beauty of this approach is that you can create your own and adjust it as priorities change.

Putting rate reviews on a predictable schedule makes them both more manageable and more efficient. You, your staff, your board or council, and your customers will all come to know exactly what to expect.

And because your annual reviews and your long-term roadmap are easily adjusted based on changing circumstances, you’ll be able to avoid both budget shortfalls and shocking surprises, such as those caused by an unanticipated infrastructure failure or an exceptionally wet summer, which tends to drive down revenues due to reduced irrigation.

In addition to all that, you’ll also free up capacity for special projects, such as:

- Asset replacement scheduling;

- Capital reserve planning;

- Rate structure review, or;

- Cost of service analysis.

You’ll be able to plan for these projects over your multi-year roadmap, moving things forward or back as priorities and circumstances change, which will introduce an iterative process of continuous improvement.

The Road Ahead

Think about the old way of doing things as being like a new driver with a freshly minted license. You’re out on a long, straight highway, paying attention to only that small section of road directly in front of your bumper. The result is sudden, reactive course corrections (often over-corrections) based solely on what’s immediately in front of you.

The alternative sketched out above is like gaining some experience and learning to lift your eyes to the horizon. Now you can see what’s ahead, far into the distance, allowing you to better anticipate what’s down the road and make smaller, smoother course corrections. This helps keep you on a stable path and allows you to avoid catastrophe.

If you’re interested in becoming the latter, Waterworth can be your easy-to-use, affordable co-pilot, helping guide you toward your goals. Give us a call to find out how.

Leave a Reply